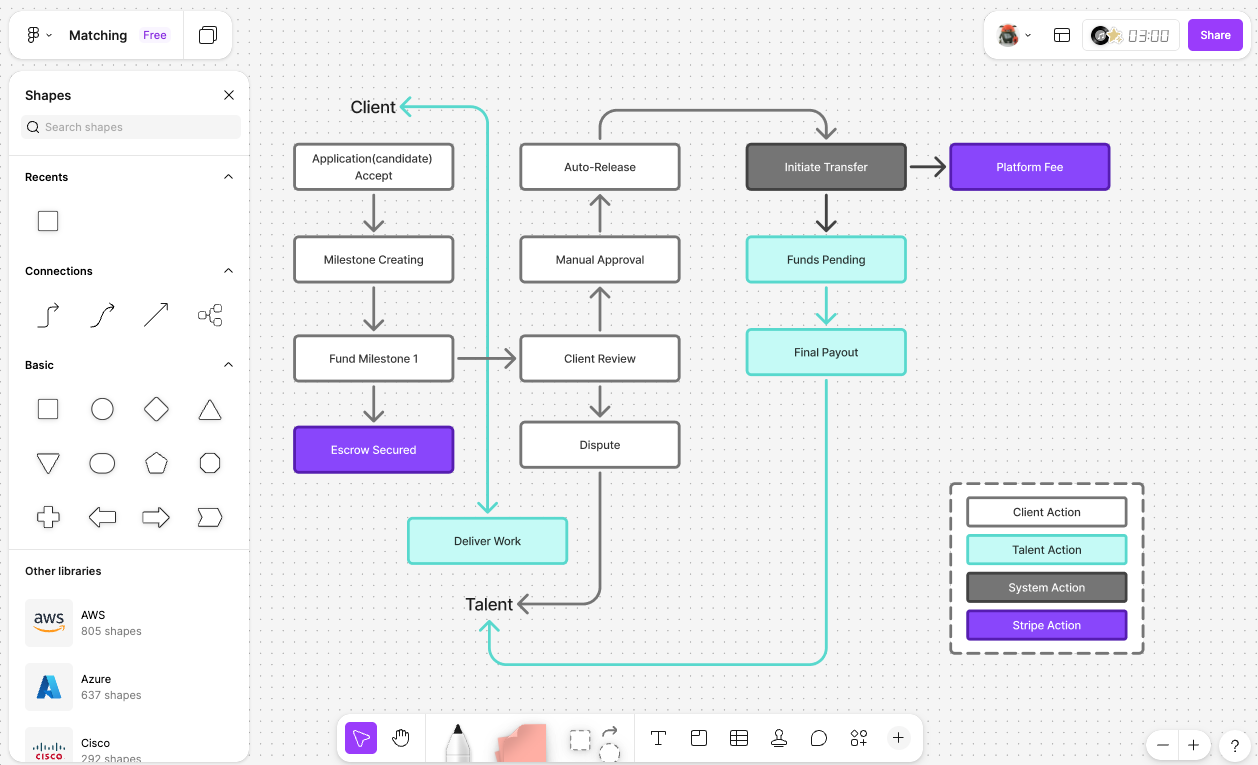

With the escrow model, the payment flow and UX are a lot more complicated than the Direct Pay model. It also requires a lot more legal compliance and production-level responsibilities.

From a UX standpoint, providing users with the context of their decision in action and what the expected consequences are is the most important point—especially in a flow where the user needs to wait for payment clearance on the solution provider’s side.

From a software development standpoint, a solid code level that covers various use cases, such as platform fee control in the event of a partial refund or partial dispute, is necessary.

Interestingly, with the Direct Pay model, I realized that the level of work required for the UX and development is not significantly different from the Escrow model. Only the business requirements and legal responsibilities are lower.

Key Differences and Implications of escrow VS Direct Pay

| Feature | Escrow Model (Your Current Plan) | Direct Pay Model |

| Payment Security | Highest. Funds are secured before work starts. Protects Talent from non-payment. | Lowest. Talent works on trust. High risk of Client non-payment after work is delivered. |

| Dispute Role | Fiduciary/Mediator. The platform holds the money and makes a final decision on its release. | Arbiter/No Financial Role. The platform can only mediate; it has no money to refund or release. Disputes become legal collections. |

| Client Trust/Retention | High. Clients trust the platform to refund them if the work is poor or unapproved. | Low. Client has no assurance of refund; may be hesitant to pay large sums upfront. |

| Platform Revenue | High Fee Potential. Fee is collected reliably on every payment processed. | High Risk of Fee Avoidance. High chance of “taking it off-platform” to avoid the fee, as payment processing is separate from work completion. |

| Legal Burden | High. Money Transmitter laws, Fiduciary Duty, AML/KYC for both parties. | Low. Mostly avoids Money Transmitter rules since you don’t hold the funds. |

Flow of Direct Pay Model

| Step | User | Action | System Status |

| 1. Offer & Scope | Client/Talent | Agree on the work and the final price outside the platform’s payment system (e.g., via chat). | Contract terms are finalized on the platform. |

| 2. Invoice Generation | Talent | Clicks “Generate Invoice” on the platform. The platform automatically adds its service fee (e.g., 5%). | Platform generates a formal invoice and sends a Stripe Payment Link or hosted checkout page to the Client. |

| 3. Client Payment | Client | Clicks the link and pays the Total Invoice Amount (Talent Fee + Platform Fee). | Payment is processed via Stripe. |

| 4. Direct Fund Routing | N/A | The Platform (via Stripe Connect) takes the Application Fee immediately. The remaining funds are routed directly and immediately to the Talent’s linked Stripe Account. | Platform never takes legal possession of the Talent’s earnings. The whsec logic confirms payment success and fee collection. |

| 5. Funds Available | Talent | N/A | Funds are subject to the Talent’s Stripe Payout Schedule (e.g., 2-7 days). |